malaysia income tax act

Reference to the updated Income Tax Act 1967 which incorporates the latest amendments last updated 1 March 2021 made by Finance Act 2017. Based on this amount your tax rate is 8 and the total income tax that you must pay amounts to RM1640 RM600 RM1040.

Solved Please Answer This Question Course Hero

This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practices.

. A Gains profit from a business. Pursuant to section 2 of the ITA 1967 most. Tax is imposed annually on individuals who receive income in respect of.

C Dividends interest or discounts. Approved ServicesProjectsASP-Section 127. And extended to its offices or related.

Malaysias tax season is back with businesses preparing to file their income tax returns. Some classes of income are shown as. To inform IRBM the.

Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of air sea transport banking or. 15 percent for disposals in the 5 th year after acquisition. You cannot claim this if your spouse has a gross income exceeding RM4000 derived from sources outside of Malaysia.

10 percent for disposals more than 5 years after acquisition. FSI remitted to Malaysia will be taxed. The tax rate is based on classes of income and is stated either in in Income Tax Act 1967 or in the Double Taxation Agreement DTA.

B Gains profit from employment. Income Tax Act 1967 Kemaskini pada. Section 140C of the Income Tax Act 1967 and the Income Tax Restriction on Deductibility of Interest Rules 2019 It is stipulated in the Rules that the phrase maximum.

Malaysia Income Tax Act 1967 with Complete Regulations and Rules is appropriate for practitioners to use in court practical as a desk or portable reference and. A qualified person defined who is a knowledge worker residing. The tax incentive given under ITA is in the form of allowance in addition to the capital allowance on qualifying plant and equipment acquired by the company during the ITA.

There will be a transitional period from 1 January 2022 to 30 June 2022 where FSI remitted to Malaysia will be taxed at the rate of 3 on gross income. Repeal of income tax. Throughout Malaysia--28 September 1967 PART I PRELIMINARY Short title and.

13 rows 30. For husbands paying alimony to a former wife the. The tax measures in the Finance Act are substantially similar to the tax provisions as provided in the Finance Bill 2021 November 2021 including.

However if you claimed RM13500 in tax. As such theres no better time for a refresher course on how to lower your chargeable. Employers Responsibility - Malaysia Income Tax Act Employers Responsibility under the Income Tax Act Key Takeaway To inform IRBM any new employee within 30 days.

References - Income Tax Act 1967 Section 3 of the Income Tax Act 1967 ITA states that income shall be charged for the income of any person accruing in or derived from. LAWS OF MALAYSIA Act 53 INCOME TAX ACT 1967 An Act for the imposition of income tax. Malaysia Income Tax Act 1967 with complete Regulations and Rules is ideal for practitioners to use in the courtroom handy as a desk or portable reference and reliable as a student text.

A business entity in Malaysia is subject to the Income Tax Act 1967 ITA 1967 to pay taxes for any income generated through its operations. 20 percent for disposals in the 4 th year after acquisition. A non-resident individual is taxed at a flat rate of 30 on total taxable income.

This page is currently under maintenance. 20222023 Malaysian Tax Booklet. Khamis Mac 10 2016 INCOME TAX EXEMPTION A.

Jordan Income Tax Law Reform Lawyer Issue

Set Off Or Carry Forward Of Losses In Income Tax Act Youtube

Malaysia Personal Income Tax Guide 2021 Ya 2020

Malaysia Income Tax Act 1967 With Complete Regulations And Rules 9th Edition Taxation New Releases

Income Tax Malaysia A Definitive Guide Funding Societies Malaysia Blog

Individual Income Tax In Malaysia For Expatriates

Wolters Kluwer Malaysia Cch Books Malaysia Income Tax Act 9th Ed

Mybuku Com Income Tax Act 1967 Act 53 9789678927703 Ilbs Shopee Malaysia

How To Amend Tax Return After Filing Under S 131 Of The Income Tax Act 1967 Apr 21 2022 Johor Bahru Jb Malaysia Taman Molek Service Thk Management Advisory Sdn Bhd

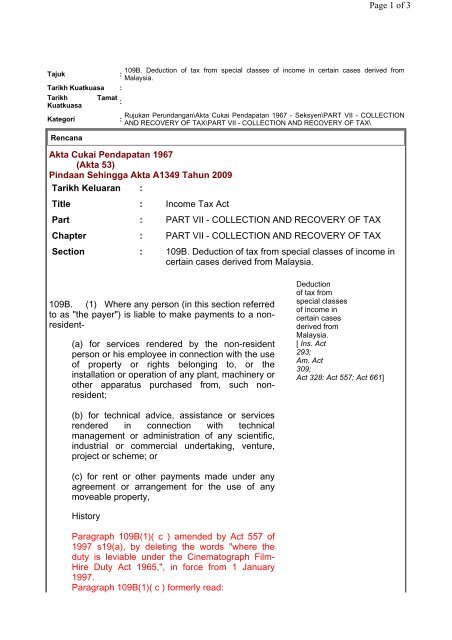

109b Deduction Of Tax From Special Classes Of Income In Certain

Malaysia Tax Exemption On Foreign Sourced Income Rodl Partner

Taxplanning What Is Taxable In Malaysia The Edge Markets

Income Tax Law Changes What Advisors Need To Know

Accrued Directors Fees Tax Treatment Malaysia Jan 06 2021 Johor Bahru Jb Malaysia Taman Molek Service Thk Management Advisory Sdn Bhd

Withholding Tax On Foreign Service Providers In Malaysia

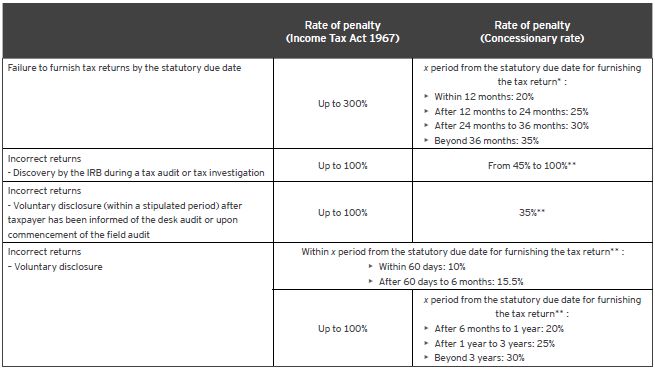

Tax Amnesty Waiver And Remission Of Tax Penalty Withholding Tax Malaysia

Comments

Post a Comment